Description

📘 1. General Introduction

A Permanent Account Number (PAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It serves as a unique identity for individuals, companies, and entities involved in taxable transactions. Introduced under the Indian Income Tax Act of 1961, the PAN is primarily used for tracking financial transactions and preventing tax evasion. For individuals, PAN acts as a bridge between their financial records and the government’s tax system. PAN is now mandatory for various daily life transactions, making it a crucial document for financial identity in India.

Whether you are a salaried employee, self-employed professional, freelancer, student earning income, or even a non-resident Indian (NRI), applying for a PAN is essential. With the digital revolution, PAN applications have become more streamlined and accessible through both online and offline platforms. The PAN card, which carries the PAN number along with personal details like name, DOB, photo, and signature, is issued by either NSDL (Protean) or UTIITSL, both authorized by the Income Tax Department.

🧾 2. Why PAN is Important

🔍 a. Financial Identity & Tax Compliance

PAN acts as a universal financial identifier. For the Income Tax Department, it helps monitor high-value financial transactions, trace income, and ensure tax compliance. For the individual, PAN ensures transparency and legal recognition of their financial dealings. It’s a cornerstone document when filing Income Tax Returns (ITRs), claiming tax refunds, and avoiding Tax Deducted at Source (TDS) at higher rates.

🏦 b. Mandatory for Opening Bank Accounts

Most financial institutions in India require PAN when opening a savings, current, or fixed deposit account. It is used for customer due diligence (KYC) and helps track the financial health and activities of the individual. Banks link PAN with account transactions to report high-value operations (like cash deposits over ₹10 lakh) to the tax authorities.

📑 c. Required for High-Value Transactions

The government mandates PAN for various high-value financial transactions, such as:

- Purchase or sale of immovable properties over ₹10 lakh

- Investments in mutual funds above ₹50,000

- Buying jewelry above ₹2 lakh

- Cash deposits above ₹50,000 in a single day

This helps maintain a record of potentially taxable income and curbs the circulation of black money.

🧾 d. Helps Avail Loans & Credit Cards

PAN is crucial when applying for personal loans, home loans, car loans, or credit cards. Financial institutions use it to check the applicant’s credit history, verify their identity, and evaluate tax records. Without a PAN, loan applications may be delayed or rejected due to incomplete KYC.

🌐 e. Facilitates Investments and Demat Accounts

PAN is a must-have to invest in stocks, mutual funds, or bonds. Opening a Demat account with a broker or subscribing to an IPO requires PAN. SEBI mandates PAN to ensure transparency and protect investors in the capital market. It also prevents benami transactions in the stock market.

📍 3. Where PAN is Required

🏦 a. Bank & Financial Institutions

Almost all banking services and transactions now require PAN. Whether you are opening a bank account, applying for a loan, depositing cash, or creating a fixed deposit over ₹50,000, PAN is indispensable. Banks and NBFCs use PAN to report high-value transactions to the tax department through the AIR (Annual Information Report).

💼 b. Income Tax Related Matters

PAN is mandatory to:

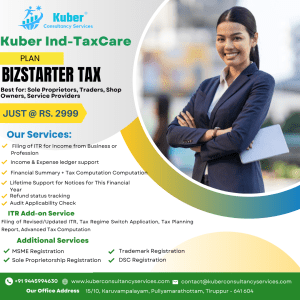

- File Income Tax Returns (ITR)

- Track tax liabilities

- Apply for TDS certificates

- Claim TDS refunds

Without PAN, individuals risk being taxed at a higher rate (usually 20%) and face delays in refunds and assessments.

💳 c. Credit/Debit Card Issuance

Most banks require PAN while issuing credit or debit cards. The PAN helps establish financial credibility and aids in verification by credit bureaus like CIBIL. It forms part of the KYC documentation to evaluate spending patterns, credit limits, and repayment behavior.

🏠 d. Real Estate Transactions

PAN is a key requirement during purchase, sale, or lease of immovable properties. For transactions above ₹10 lakh, both buyer and seller must quote their PAN. This ensures the legitimacy of property deals and discourages under-the-table cash dealings.

💎 e. Purchase of Assets and Luxury Items

If you purchase high-value goods like gold, cars, jewelry, or foreign travel tickets, you must provide your PAN. Retailers and travel agents are required to collect PAN details for transactions exceeding prescribed thresholds to keep financial dealings in check.

🛠️ 4. Various Ways to Apply for PAN

🌐 a. Online Application via NSDL (now Protean)

The Protean (formerly NSDL) platform offers a seamless online interface for PAN applications. Applicants can fill Form 49A (for residents) and upload required documents. Payment can be made via net banking, debit card, UPI, etc. Once verified, the PAN card is delivered to your postal address, and e-PAN is sent by email.

🖥️ b. Online Application via UTIITSL

UTI Infrastructure Technology Services Ltd (UTIITSL) also offers a similar online application facility. It’s particularly popular for e-KYC based applications using Aadhaar. Applicants can track their PAN status, download e-PAN, and receive SMS/email alerts throughout the process.

🏢 c. Offline Application through PAN Centers

For those who prefer physical documentation, authorized PAN centers across cities and towns accept offline applications. Applicants can submit Form 49A, along with passport-size photographs and documents in person. This is especially useful in rural or semi-urban areas with limited internet access.

📱 d. PAN via Aadhaar-based Instant e-PAN

For individuals with a valid Aadhaar linked to a mobile number, the Income Tax Department offers a free Instant e-PAN facility. This is a paperless and real-time process where PAN is issued instantly in digital form. It uses Aadhaar-based OTP authentication and auto-fetches details from UIDAI.

📞 e. Through Facilitation Centers / Agents

Several authorized agents and service centers (including banks, post offices, and CSCs) assist individuals in PAN applications. These centers guide in form filling, documentation, and biometric verification. While it involves a small service fee, it helps those unfamiliar with the online system.

📄 5. Documents Required for PAN Application

🪪 a. Proof of Identity (POI)

Acceptable POI documents include:

- Aadhaar Card (most preferred)

- Voter ID

- Passport

- Driving License

- Ration Card with photograph

The document must carry your full name, photo, and date of birth. If you’re applying online, scanned images in specified format (PDF/JPEG) are sufficient. In case of offline application, self-attested photocopies are to be submitted.

🏠 b. Proof of Address (POA)

Accepted POA documents include:

- Aadhaar Card

- Utility Bills (electricity/water/telephone)

- Bank Account Statement

- Passport

- Rent Agreement

The address proof ensures that the PAN card is dispatched to a valid and accessible residential address. It should not be older than 3 months and must reflect the current address in use.

🎂 c. Proof of Date of Birth (DOB)

DOB proof is required to validate the applicant’s age and identity. Documents accepted include:

- Birth Certificate

- Matriculation Certificate

- Passport

- Aadhaar

- Voter ID

The name and date on the document must exactly match the application form to avoid rejection.

📸 d. Photographs and Signature

For physical PAN cards, two recent passport-size photographs are mandatory. Applicants must also provide a signature specimen either physically (for offline) or digitally (for online). For e-PAN, this step may be bypassed if Aadhaar is used.

🆕 6. Additional Topics

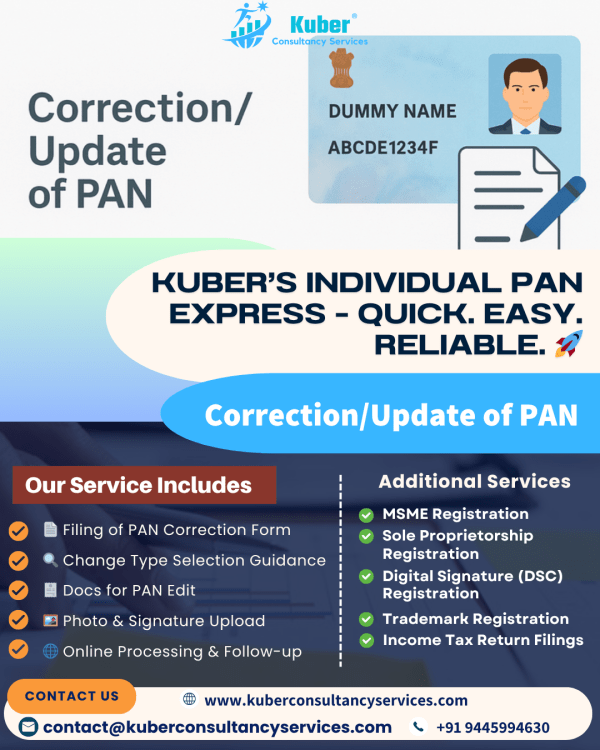

📤 a. Correction/Update in PAN

If there’s an error in your name, DOB, address, or photo on the PAN card, you can apply for PAN correction using the same online/offline methods. You need to submit proof of the correct data and pay the applicable fee. A corrected PAN card will be issued after verification.

📧 b. e-PAN and Its Uses

The e-PAN is a digitally signed PAN issued in PDF format. It holds the same legal validity as the physical PAN card. It is especially useful for instant submissions in online applications like KYC, digital onboarding, and quick verifications.

🌍 c. PAN for NRIs (Non-Resident Indians)

NRIs who have Indian income (rent, dividends, etc.) or intend to invest in Indian securities must apply for PAN. The process is similar, but documents must be attested by an Indian embassy or notary. The PAN card helps NRIs comply with Indian tax regulations.

📅 d. PAN Card Validity

PAN is valid for a lifetime, unless voluntarily surrendered or deactivated by the Income Tax Department for duplication or fraud. It does not expire or require renewal, though it must be updated in case of change in personal details.

Reviews

There are no reviews yet