Description

What This Service Is

A Sole Proprietorship is one of the simplest forms of business structure in India, owned and managed by a single individual. In this structure, the proprietor and the business are legally the same entity.

This service provides professional assistance for setting up a Sole Proprietorship business in India by obtaining the required statutory and tax registrations applicable to the nature of business.

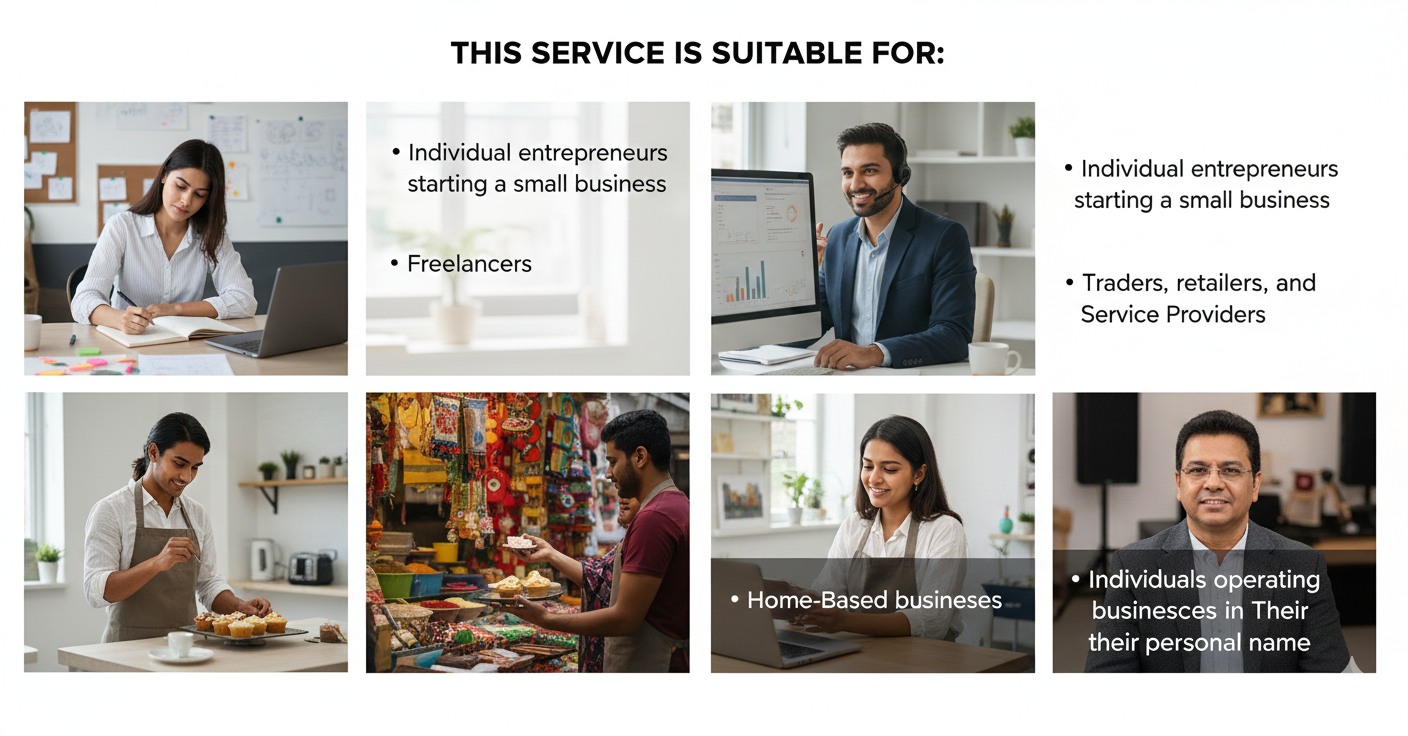

Who Should Opt for This Service

This service is suitable for:

• Individual entrepreneurs starting a small business

• Freelancers and consultants

• Traders, retailers, and service providers

• Home-based businesses

• Individuals operating businesses in their own name or trade name

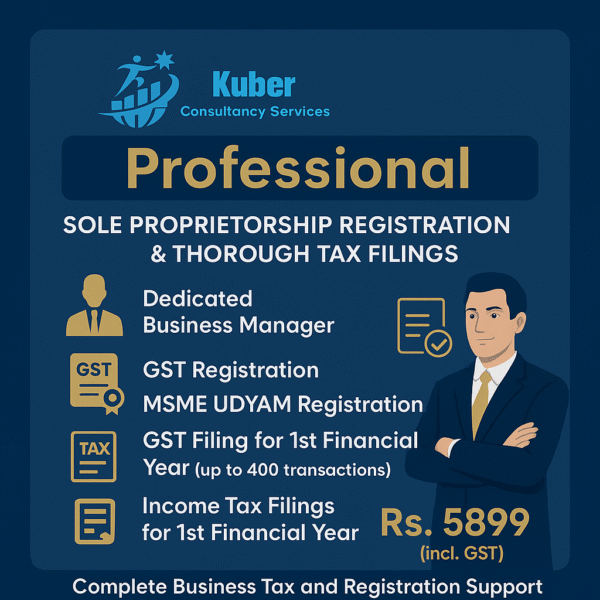

Scope of Service (What We Will Do)

Under this service package, we assist with:

• Consultation on suitability of sole proprietorship structure

• Registration through applicable government registrations such as GST, MSME (Udyam), or Shop & Establishment, as applicable

• Documentation guidance and verification

• Support in obtaining basic registrations required to operate the business

How the Service Is Delivered

This is a professional consultancy service delivered digitally.

After successful payment:

A Dedicated Business Manager is assigned

Documents are collected through the secure portal

Consultation and clarifications are handled online

Status updates are provided through the dashboard

No physical visit or paperwork exchange is required.

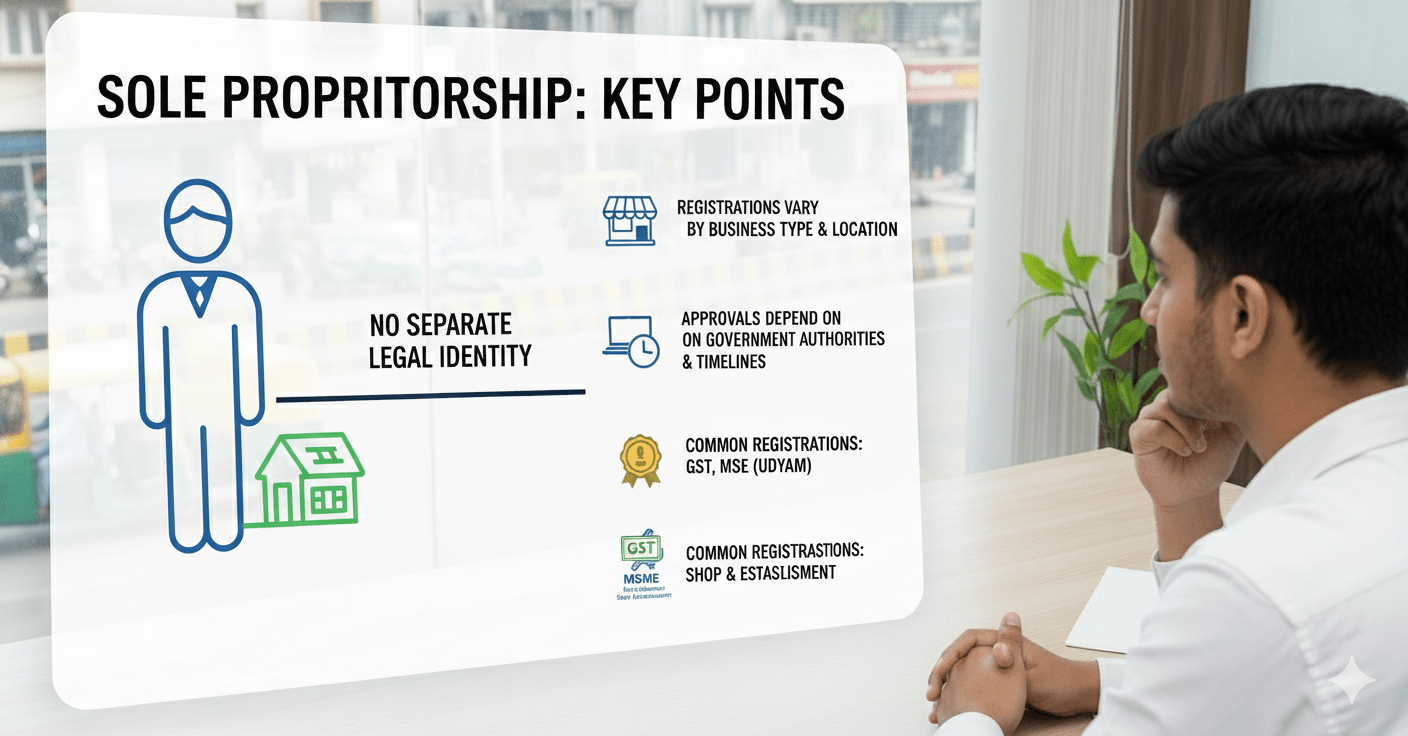

Important Notes & Legal Clarification

A Sole Proprietorship does not have a separate legal identity

The proprietor has unlimited personal liability

Registrations depend on business activity, location, and applicable laws

Approval timelines are governed by the respective departments

Nature of Service

This service package is listed as a virtual product only for online booking and payment purposes.

No physical goods are supplied or delivered.

What is Sole Proprietorship Registration in India?

In India, a sole proprietorship is one of the simplest and oldest business structures to establish. It is a type of business owned and operated by a single individual, known as the proprietor.

Because the proprietor and the business are considered one and the same, setting up a sole proprietorship is quick and easy, with minimal compliance requirements. However, it’s important to note that a sole proprietorship cannot have partners or shareholders.

One key aspect to remember is that there is no limited liability protection for the proprietor in a sole proprietorship. As such, this structure is ideal for small businesses, typically those with fewer than five employees.

At Kuber Consultancy Services, we specialize in assisting entrepreneurs with the registration of their sole proprietorships. Our simple and efficient process makes registering your business online quick and hassle-free. With our expert assistance, you can set up your sole proprietorship and bring your business ideas to life.

Unlike other business structures, a sole proprietorship doesn’t require a formal registration process from the government. Instead, it is recognized through various tax registrations required by law, such as GST (Goods and Services Tax) registration. This tax registration, in the name of the proprietor, formalizes the business as a sole proprietorship, allowing you to operate under this structure with full compliance.

How Kuber Consultancy Services Simplifies Sole Proprietorship Registration?We connect you with top incorporation experts who simplify the complexities of sole proprietorship registration. Our professionals work closely with you to meet all legal requirements while keeping you updated through our user-friendly online platform. From handling paperwork to coordinating with government authorities, we ensure a smooth and hassle-free process. We provide clear guidance on the registration process to set realistic expectations. With a dedicated team of over 100 experienced business manager and legal professionals, exceptional legal services are just through an App. |

Advantages of Sole Proprietorship Registration

Simple Registration: The registration process for a sole proprietorship is straightforward, as there is no formal incorporation or dissolution procedure. Since the business and the proprietor are the same entity, the owner may only need to acquire specific registrations and licenses to ensure compliance with Indian laws and regulations.

Lower Compliance Requirements: Sole proprietorships typically only need to be registered with government bodies like the Income Tax Department and GST authorities, resulting in fewer compliance obligations. In contrast, entities like LLPs or companies must register with the Ministry of Corporate Affairs and adhere to more stringent filing requirements and annual audits by a Chartered Accountant.

Ease of Operations: With no partners, shareholders, or directors, a sole proprietor can manage the business with minimal documentation and approvals. This makes the structure ideal for small businesses with limited operations.

Quick Business Decisions: In a sole proprietorship, the owner has full autonomy over decision-making. There is no need for approval from other parties, allowing the proprietor to make quick, flexible decisions that align with business needs.

Full Control: As the sole owner of the business, the proprietor retains complete control over all aspects, including assets, revenue, expenses, and business operations. This provides a high degree of flexibility and authority in managing the business.

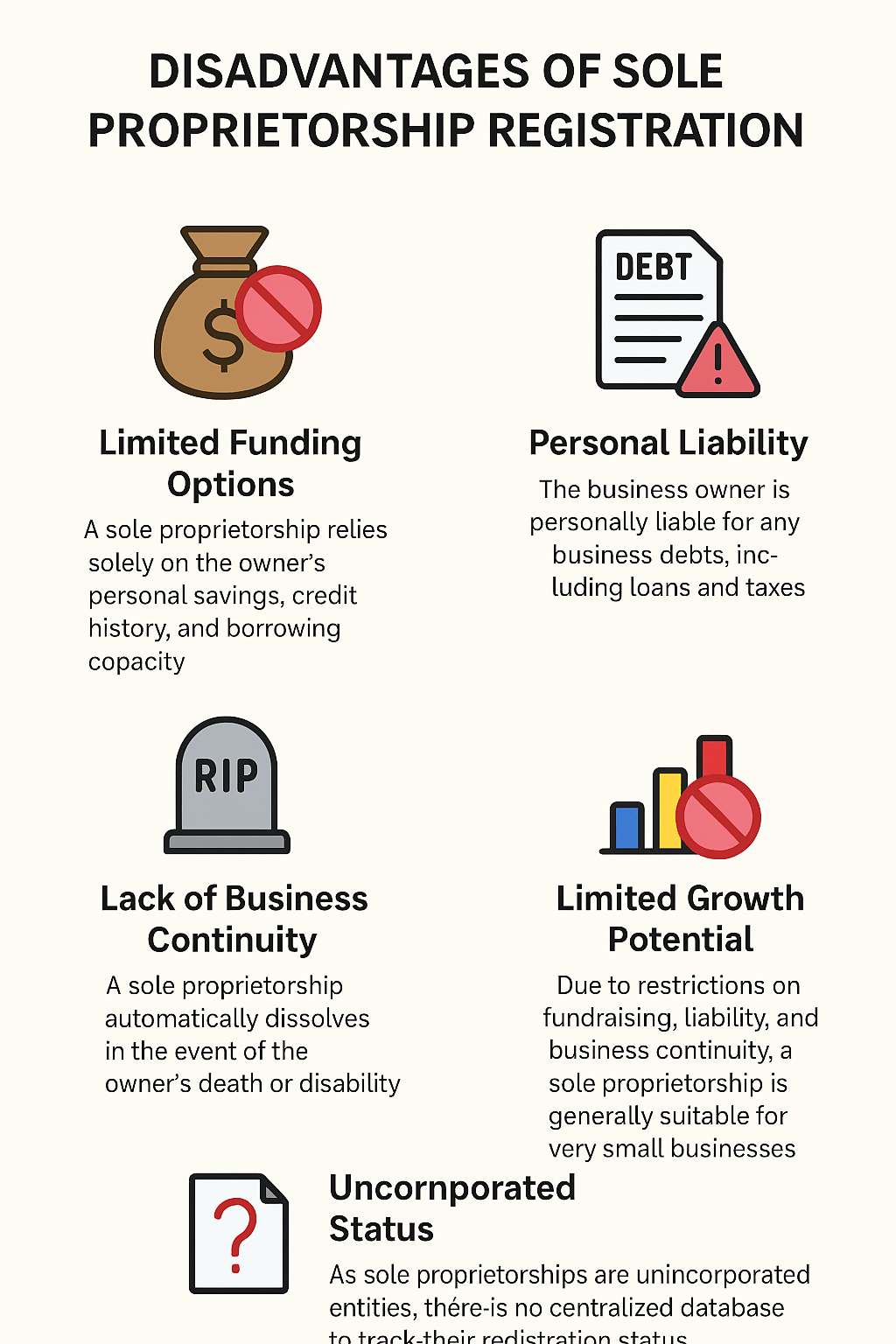

Disadvantages of Sole Proprietorship Registration

Limited Funding Options: A sole proprietorship relies solely on the owner’s personal savings, credit history, and borrowing capacity. With no partners involved, securing funds from banks can be challenging. Additionally, raising equity funds is not an option, as this business structure does not accommodate profit sharing or issuing shares.

Personal Liability: In a sole proprietorship, the business owner is personally liable for any business debts, including loans and taxes. If the business cannot meet its financial obligations, the proprietor’s personal assets could be at risk, meaning they are accountable for the business’s liabilities until they are fully settled.

Lack of Business Continuity: A sole proprietorship lacks continuity in the event of the owner’s death or disability, as the business is automatically dissolved. There is no legal structure in place for the smooth continuation of the business after such an occurrence.

Limited Growth Potential: Due to restrictions on fundraising, liability, and business continuity, a sole proprietorship is generally suitable for only very small businesses in the unorganized sector. These limitations hinder expansion and scalability.

Unincorporated Status: As sole proprietorships are unincorporated entities, there is no centralized database to track their registration status, making it difficult to determine whether a sole proprietorship is active or inactive. As a result, these businesses are often categorized as part of the unorganized sector.

Checklist for Sole Proprietorship Registration in India

To successfully register a sole proprietorship in India, follow this checklist:

Select an Appropriate Business Name: Choose a unique and suitable name for your sole proprietorship business.

Open a Business Bank Account: Set up a bank account in the name of your business.

Register under GST: Get your business registered under GST Law and obtain GSTIN

Register as an MSME: Get registered as a Micro, Small, and Medium Enterprise (MSME), if applicable.

Obtain Required Licenses: Acquire necessary licenses, such as the FSSAI license or Shop and Establishment Act license.

Register for ESIC or EPFO: Depending on your business requirements, register for Employee State Insurance Corporation (ESIC) or Employees’ Provident Fund Organization (EPFO).

Obtain Shop and Establishment Act Certification: Ensure you obtain all necessary certifications under the Shop and Establishment Act of 1947, if applicable to your business.

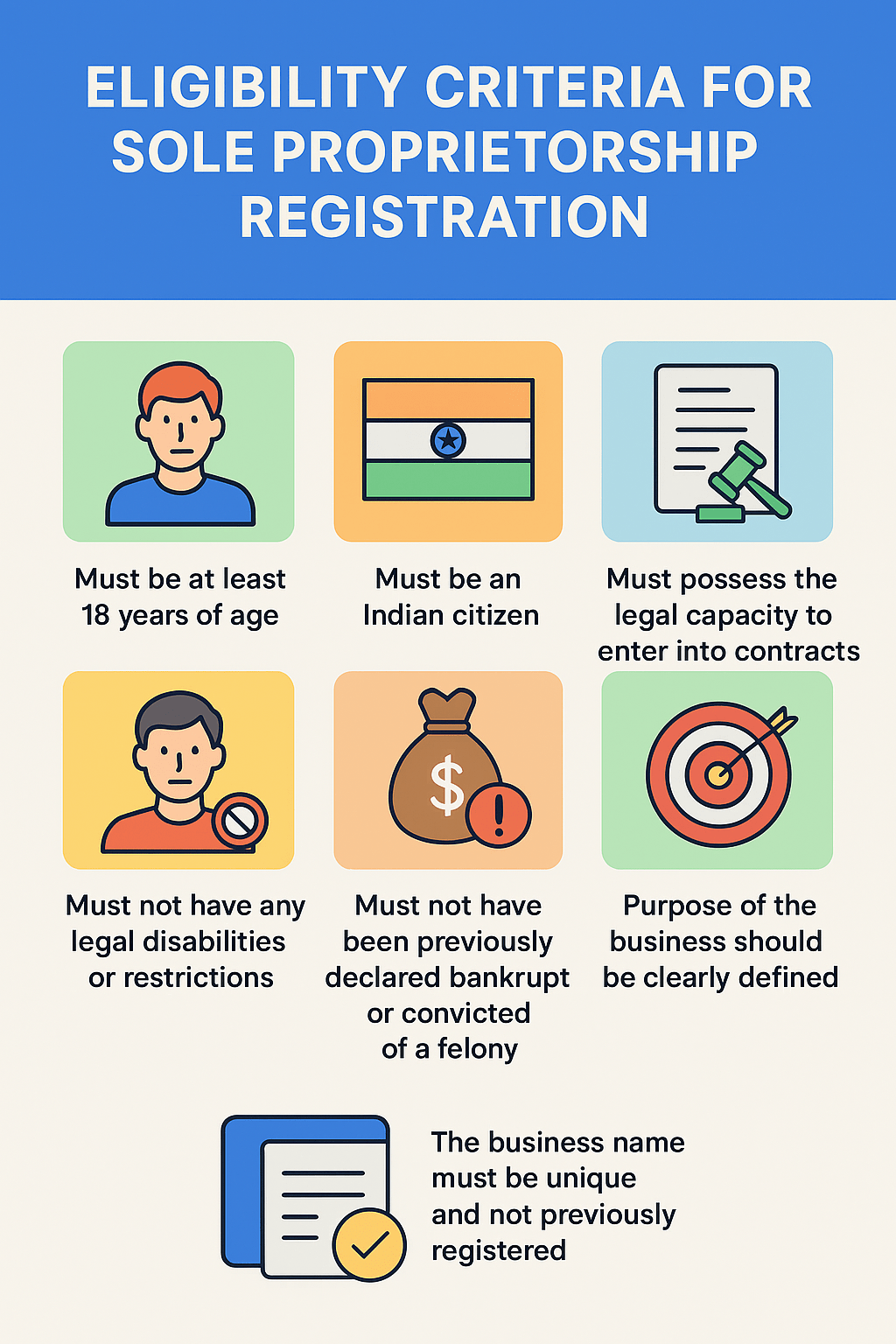

Eligibility Criteria for Sole Proprietorship Registration

To qualify for sole proprietorship registration, the applicant must meet the following criteria:

- The applicant must be at least 18 years of age.

- The applicant should be an Indian citizen.

- The applicant must possess the legal capacity to enter into contracts.

- The proprietor must not have any legal disabilities or restrictions.

- The applicant should not have been previously declared bankrupt or convicted of a felony.

- The purpose of the business should be clearly defined at the time of starting the sole proprietorship.

- The business must engage in lawful activities and must not involve the sale of illegal goods or services.

- The business name must be unique and not previously registered.

Compliance Requirements for Proprietorships in India

Sole proprietorships must adhere to the following compliance requirements:

- Income Tax Filing:

- The business owner must file personal income tax return using Form ITR-3 or ITR-4.

- These forms are specifically designed for declaring business income under the proprietorship structure.

- Business Income Reporting:

- Proprietorships are required to use either Form ITR-3 or ITR-4 to report business income, ensuring compliance with income tax regulations.

- GST Return Filing:

- If the proprietorship is registered under GST, monthly or quarterly GST returns must be filed based on the applicable GST scheme.

- TDS Returns:

- If the proprietorship employs staff or procures goods/services beyond a specified threshold, it is required to deduct tax at source (TDS) and file quarterly TDS returns.

- Additional Compliance:

- Depending on the industry and location, other regulatory requirements may also apply to the proprietorship.

Comparison of Sole Proprietorship with Other Business Structures

Sole Proprietorship vs Partnership Firm

| Aspect | Sole Proprietorship | Partnership |

| Legal Status | Not a separate legal entity; the owner and the business are considered the same. | Not a separate legal entity; partners and the firm are considered the same. |

| Liability | Unlimited liability; the owner is personally liable for all business debts and obligations. | Unlimited liability; partners are jointly and severally liable for the firm’s debts and obligations. |

| Registration | No formal registration required; however, licenses like GST registration may be necessary based on business activity. | Can be registered or unregistered; if registered, it’s under the Partnership Act, 1932. |

| Number of Owners/Partners | Single owner. | Minimum of 2 partners; maximum limit varies by state laws. |

| Taxation | Income is taxed as personal income of the owner. | Income is taxed as personal income of the partners. |

| Compliance Requirements | Minimal compliance; primarily involves filing personal income tax returns and maintaining basic accounts. | Moderate compliance; includes partnership deed, filing income tax returns, and maintaining books of accounts. |

| Continuity | Business continuity is affected by the owner’s incapacity or death. | May be dissolved upon the death or withdrawal of a partner, unless otherwise agreed upon. |

| Decision Making | Sole decision-making authority lies with the owner. | Decisions are made jointly by the partners as per the partnership agreement. |

| Funding and Investment | Limited to the owner’s resources and borrowing capacity. | Capital is contributed by partners; raising funds beyond partners can be challenging. |

| Dissolution | Easy to dissolve; involves settling debts and liabilities. | Can be dissolved by mutual consent, court order, or as per the partnership deed. |

Sole Proprietorship vs Limited Liability Partnership

| Aspect | Sole Proprietorship | LLP |

| Legal Status | Not a separate legal entity; the owner and the business are considered the same. | Separate legal entity registered under the Limited Liability Partnership Act, 2008. |

| Liability | Unlimited liability; the owner is personally liable for all business debts and obligations. | Limited liability; partners’ liability is limited to their agreed contribution. |

| Registration | No formal registration required; however, licenses like GST registration may be necessary based on business activity. | Must be registered with the Ministry of Corporate Affairs under the LLP Act, 2008. |

| Number of Owners/Partners | Single owner. | Minimum of 2 partners; no maximum limit. |

| Taxation | Income is taxed as personal income of the owner. | Taxed as a separate entity; profits are taxed at the applicable corporate tax rate. |

| Compliance Requirements | Minimal compliance; primarily involves filing personal income tax returns and maintaining basic accounts. | Higher compliance; includes annual filings, maintaining statutory records, and auditing (subject to certain conditions). |

| Continuity | Business continuity is affected by the owner’s incapacity or death. | Perpetual succession; not affected by changes in partners. |

| Decision Making | Sole decision-making authority lies with the owner. | Decisions are made by designated partners as outlined in the LLP agreement. |

| Funding and Investment | Limited to the owner’s resources and borrowing capacity. | Easier to raise funds compared to proprietorship and partnership; can admit new partners. |

| Dissolution | Easy to dissolve; involves settling debts and liabilities. | Can be dissolved voluntarily or by an order of the National Company Law Tribunal (NCLT). |

Sole Proprietorship vs Company

| Aspect | Sole Proprietorship | Company |

| Legal Status | Not a separate legal entity; the owner and the business are considered the same. | Separate legal entity registered under the Companies Act, 2013. |

| Liability | Unlimited liability; the owner is personally liable for all business debts and obligations. | Limited liability; shareholders’ liability is limited to their share capital. |

| Registration | No formal registration required; however, licenses like GST registration may be necessary based on business activity. | Must be registered with the Ministry of Corporate Affairs under the Companies Act, 2013. |

| Number of Owners/Partners | Single owner. | Minimum of 2 and maximum of 200 shareholders (In case of Private Limited Company). |

| Taxation | Income is taxed as personal income of the owner. | Taxed as a separate entity; subject to corporate tax rates. |

| Compliance Requirements | Minimal compliance; primarily involves filing personal income tax returns and maintaining basic accounts. | High compliance; includes annual filings with the Registrar of Companies, maintaining statutory registers, conducting board meetings, and mandatory audits. |

| Continuity | Business continuity is affected by the owner’s incapacity or death. | Perpetual succession; not affected by changes in shareholders or directors. |

| Decision Making | Sole decision-making authority lies with the owner. | Decisions are made by the board of directors; major decisions require shareholders’ approval. |

| Funding and Investment | Limited to the owner’s resources and borrowing capacity. | Easier access to funding through equity, debt, and venture capital; can issue shares to raise capital. |

| Dissolution | Easy to dissolve; involves settling debts and liabilities. | Involves a formal winding-up process as per the Companies Act, 2013; can be time-consuming and complex. |

Frequently Asked Question

A sole proprietorship is a business owned and managed by a single individual. The owner and the business are legally the same entity, and there is no separate legal identity for the business.

There is no single formal registration for sole proprietorships. However, businesses must obtain applicable registrations such as GST, MSME (Udyam), or local licenses based on the nature of business.

Any Indian citizen who is at least 18 years old and legally capable of entering into contracts can start a sole proprietorship.

GST registration is mandatory if turnover exceeds prescribed limits, or if the business involves inter-state trade, e-commerce, or other specified activities.

Common documents include PAN and Aadhaar of the proprietor, address proof of business premises, bank account details, and applicable licenses or registrations.

Yes. A sole proprietor can operate under a trade name by obtaining supporting registrations such as GST, MSME, or Shop & Establishment license.

No. A sole proprietorship does not have a separate legal identity. The proprietor is personally responsible for all business liabilities.

A sole proprietorship is easier to start and manage but has unlimited liability. Companies offer limited liability and better scalability but involve higher compliance.

Timelines depend on the type of registrations required and processing time of the respective government authorities.

How is the service delivered after payment?

Yes, a sole proprietor can open a bank account or register under a trade name by submitting the required documents, such as a GST certificate, MSME certificate, or shop and establishment license.

Recent Blogs on Updates

Check below the recent updates:

No posts found!

Recent Videos on Updates

Check below the recent updates:

What can I find on Kuber Consultancy Services?

Kuber Consultancy Services offers comprehensive information coverage with regular updates, detailed analysis, and valuable content to keep you informed.

How often is the content updated?

We regularly update our information content to ensure you have access to the latest and most accurate information available in the industry.

Why choose Kuber Consultancy Services for information?

Kuber Consultancy Services is committed to providing reliable, well-researched information content from experienced contributors and trusted sources.

Overall, I had a good experience with Kuber Consultancy Services for my Sole Proprietorship registration. The process was handled professionally and completed on time. There were a few minor delays in communication, but the team was supportive and resolved my queries properly.

Satisfied with the service and would recommend them to others.