Description

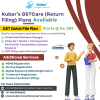

Introduction to GST Return Filing Services

GST (Goods and Services Tax) has revolutionized the Indian taxation system, streamlining indirect taxes under a single umbrella. It eliminates the cascading effect of taxes and provides transparency in taxation processes. Every business registered under GST is mandated to file periodic returns to disclose details of their sales, purchases, input tax credit (ITC), and tax liability. These filings form the basis for tax computation and compliance.

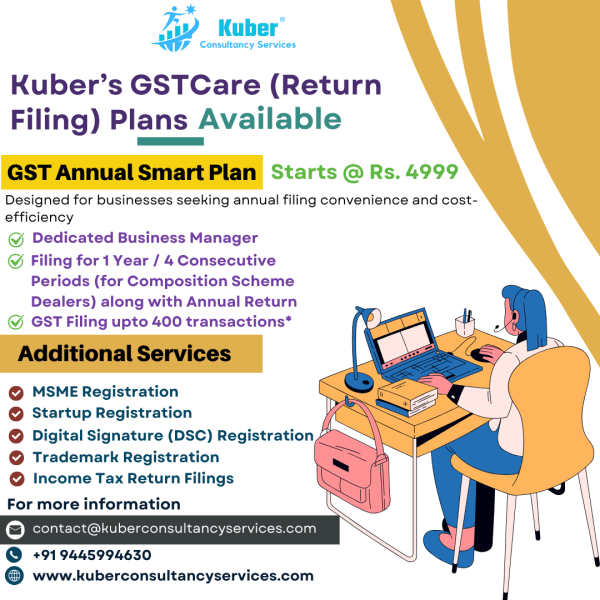

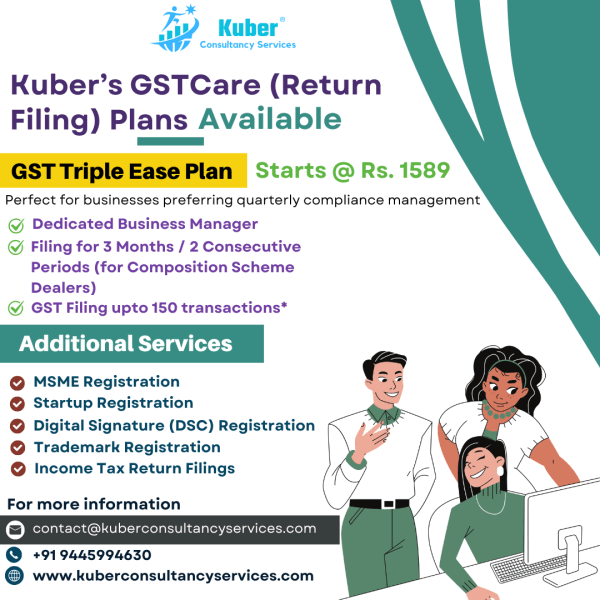

GST return filing is a vital compliance requirement. Non-compliance can result in penalties, interest, and even suspension of GST registration. Kuber Consultancy Services offers end-to-end GST Return Filing Services, ensuring your business remains compliant and benefits from efficient tax management. We take pride in simplifying the complexities of GST compliance, providing accurate and timely filings, and assisting businesses in leveraging GST benefits fully.

Our services are tailored to meet the unique requirements of businesses across industries. Whether you are a startup, a small-scale business, or an established enterprise, our expert team ensures that your GST filing process is hassle-free and compliant with the latest GST laws.

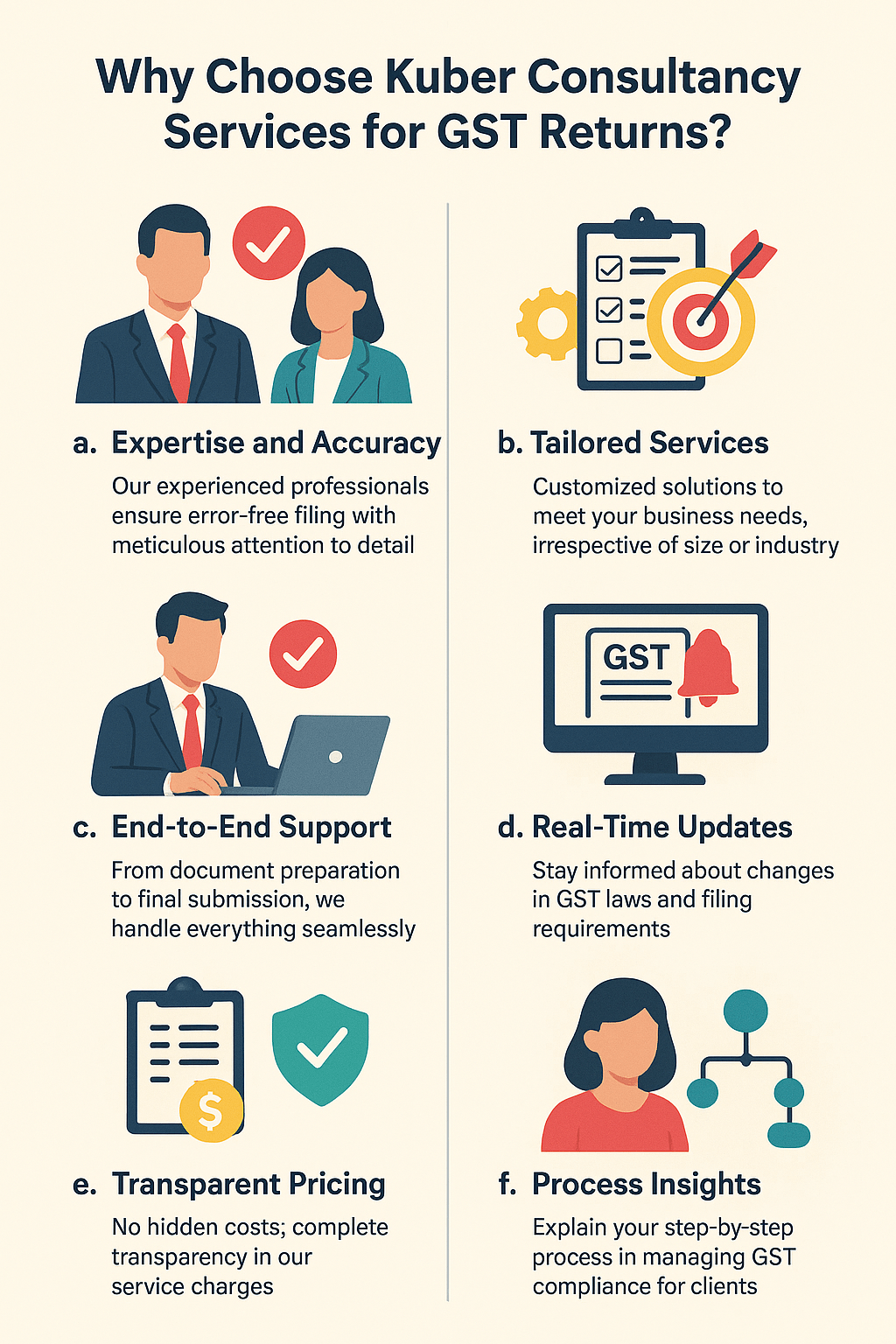

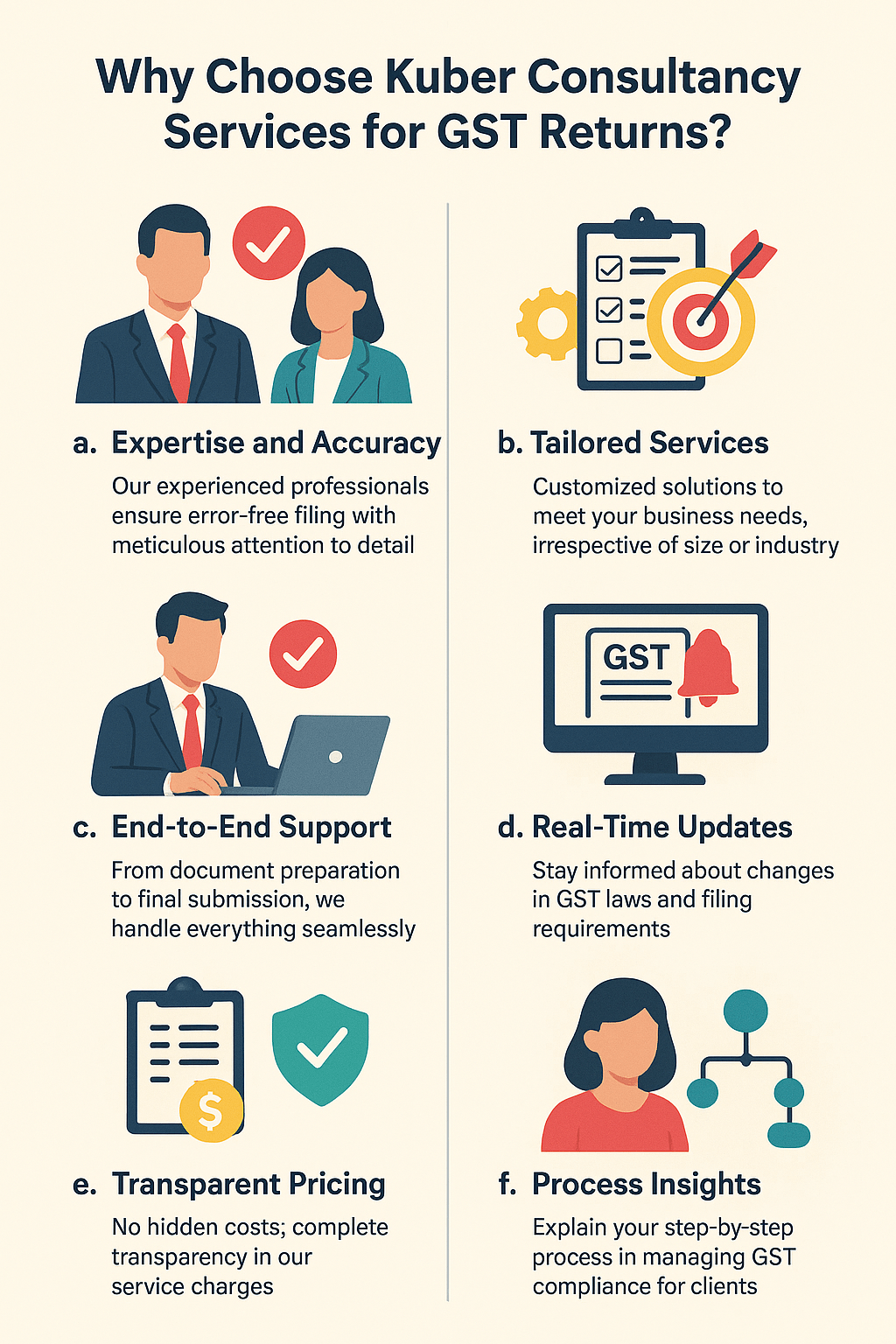

Why Choose Kuber Consultancy Services for GST Returns?

a. Expertise and Accuracy: Our experienced professionals ensure error-free filing with meticulous attention to detail. b. Tailored Services: Customized solutions to meet your business needs, irrespective of size or industry. c. End-to-End Support: From document preparation to final submission, we handle everything seamlessly. d. Real-Time Updates: Stay informed about changes in GST laws and filing requirements. e. Transparent Pricing: No hidden costs; complete transparency in our service charges. f. Process Insights: Explain your step-by-step process in managing GST compliance for clients. |

Advantages of Timely GST Return Submission

Filing GST returns on time offers numerous advantages that extend beyond mere compliance. Let us explore these benefits in detail:

- Avoidance of Penalties and Late Fees: Late filing attracts penalties of INR 50 per day for regular filings and INR 20 per day for nil returns. Over time, these fees can accumulate, significantly impacting your cash flow. Timely filing ensures you avoid such unnecessary expenses.

- Seamless Input Tax Credit (ITC): Input Tax Credit is a crucial feature of GST. It allows businesses to claim credit for the taxes paid on purchases. Timely filing ensures that your ITC claims are processed efficiently, reducing the overall tax burden.

- Enhanced Compliance Rating: The GST compliance rating is an official metric reflecting a taxpayer’s adherence to GST norms. A high compliance rating can enhance your business’s reputation and foster trust among suppliers, customers, and regulatory authorities.

- Better Cash Flow Management: GST filings involve tax payments, and timely filing helps you plan your cash flows effectively. This ensures that your business operates smoothly without financial disruptions due to tax liabilities.

- Reduced Risk of Audits and Notices: Non-compliance or delays in filing often trigger audits and scrutiny by tax authorities. Timely submissions reduce the likelihood of such interventions, saving time and resources.

- Legal Compliance and Business Reputation: Compliance with GST regulations demonstrates professionalism and responsibility, enhancing your business’s credibility in the market.

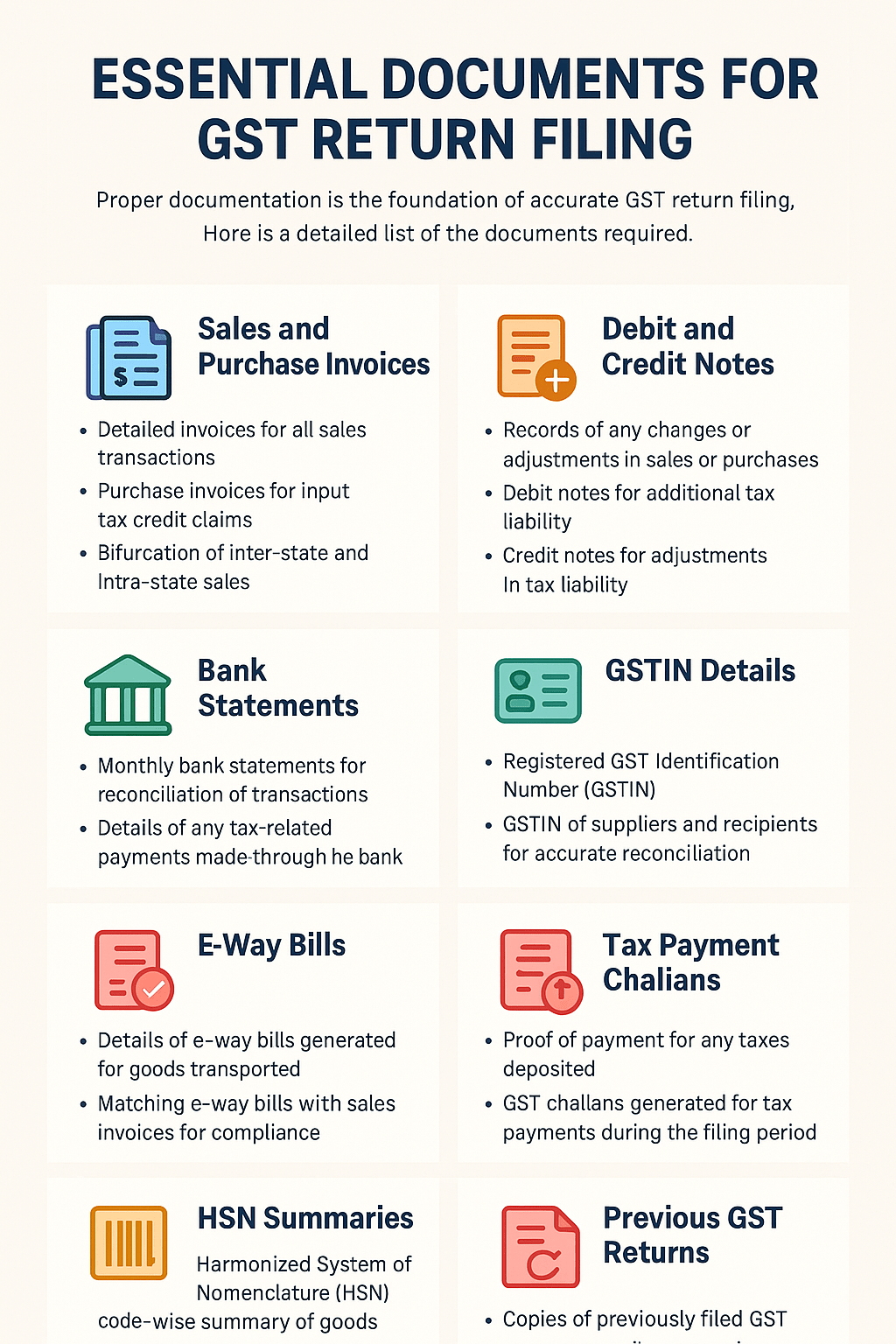

Essential Documents for GST Return Filing

Proper documentation is the foundation of accurate GST return filing. Here is a detailed list of the documents required:

- Sales and Purchase Invoices: Detailed invoices for all sales transactions, Purchase invoices for input tax credit claims & Bifurcation of inter-state and intra-state sales.

- Debit and Credit Notes: Records of any changes or adjustments in sales or purchases, Debit notes for additional tax liability & Credit notes for adjustments in tax liability.

- Bank Statements: Monthly bank statements for reconciliation of transactions & Details of any tax-related payments made through the bank.

- GSTIN Details: Registered GST Identification Number (GSTIN) & GSTIN of suppliers and recipients for accurate reconciliation.

- E-Way Bills: Details of e-way bills generated for goods transported & Matching e-way bills with sales invoices for compliance.

- Tax Payment Challans: Proof of payment for any taxes deposited & GST challans generated for tax payments during the filing period.

- HSN Summaries: Harmonized System of Nomenclature (HSN) code-wise summary of goods or services & Accurate classification of goods and services for compliance.

- Previous GST Returns: Copies of previously filed GST returns for reference and reconciliation & Ensuring consistency in filing data across periods.

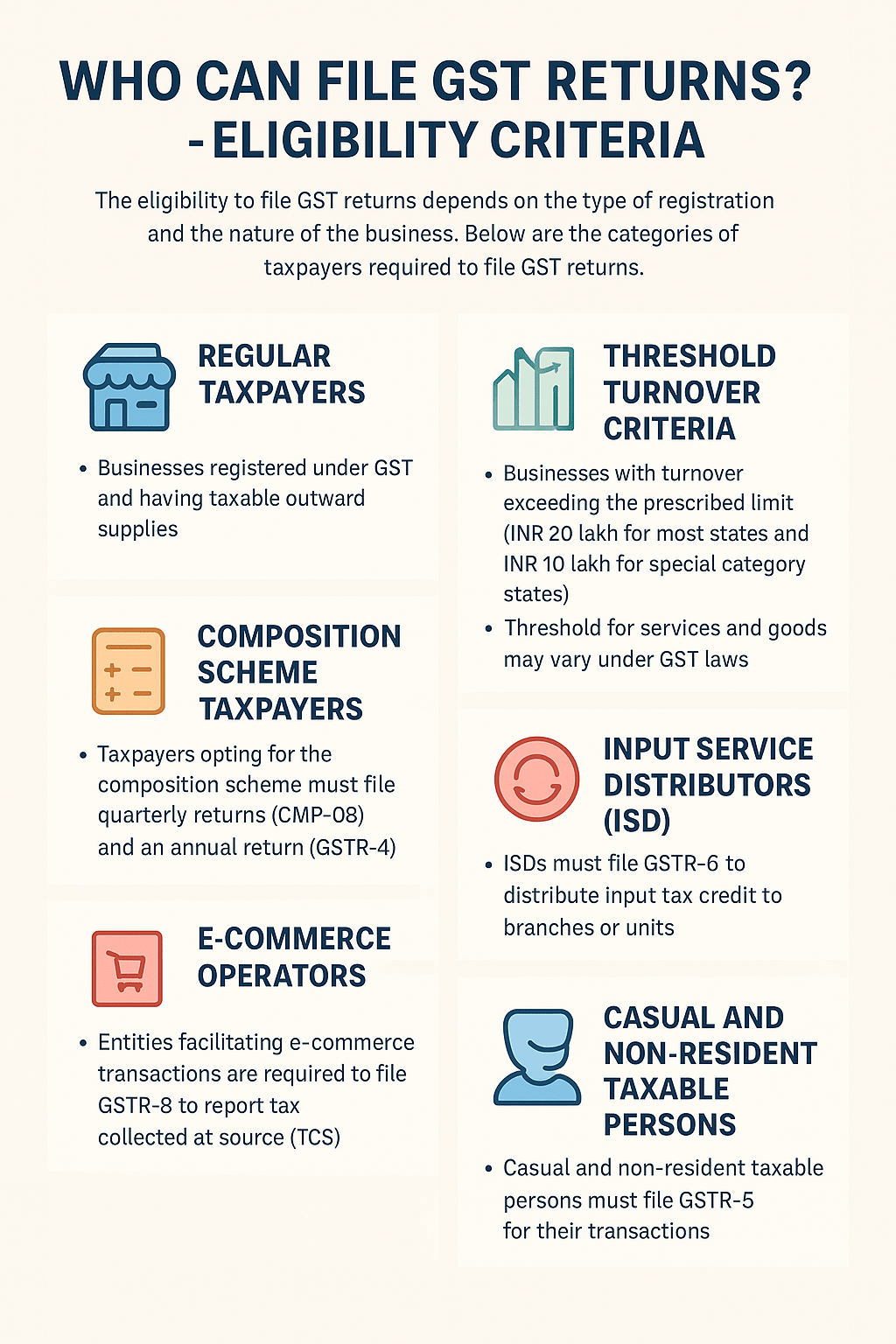

Who Can File GST Returns? – Eligibility Criteria

The eligibility to file GST returns depends on the type of registration and the nature of the business. Below are the categories of taxpayers required to file GST returns:

- Regular Taxpayers: Businesses registered under GST and having taxable outward supplies.

- Threshold Turnover Criteria: Businesses with turnover exceeding the prescribed limit (INR 20 lakh for most states and INR 10 lakh for special category states) & Threshold for services and goods may vary under GST laws.

- Composition Scheme Taxpayers: Taxpayers opting for the composition scheme must file quarterly returns (CMP-08) and an annual return (GSTR-4).

- Input Service Distributors (ISD): ISDs must file GSTR-6 to distribute input tax credit to branches or units.

- E-Commerce Operators: Entities facilitating e-commerce transactions are required to file GSTR-8 to report tax collected at source (TCS).

- Casual and Non-Resident Taxable Persons: Casual and non-resident taxable persons must file GSTR-5 for their transactions.

Checklist for Accurate GST Return Filing

To ensure error-free GST return filing, it is essential to follow a structured checklist:

- Invoice Reconciliation: Match invoices with GSTR-2A and GSTR-2B & Ensure accuracy in invoice details, including GSTIN, tax amount, and HSN codes.

- Tax Liability Computation: Calculate tax liability after adjusting input tax credit & Include tax under the reverse charge mechanism (RCM).

- E-Way Bill Compliance: Verify e-way bill details against sales invoices & Address discrepancies promptly.

- ITC Verification: Check input tax credit eligibility and ensure all claims are valid & Avoid claiming ineligible ITC to prevent penalties.

- Payment of Tax Liability: Ensure all tax dues are paid before filing returns & Generate challans and record payment details accurately.

- Filing of Nil Returns: Even businesses with no transactions must file nil returns to avoid penalties.

Consequences of Late GST Return Filing

- Financial Penalties: INR 50/day for regular returns; INR 20/day for nil returns & Interest at 18% per annum on unpaid tax liability.

- Restricted ITC Claims: Delay impacts ITC availability for suppliers, affecting their compliance as well.

- Legal and Operational Risks: Increased scrutiny from tax authorities & Risk of GST registration suspension.

- Impact on Business Reputation: Poor compliance history may deter potential partners and clients.

Improving GST Compliance with Better Ratings

a. What is GST Compliance Rating? A metric reflecting adherence to GST laws & High ratings indicate timely and accurate compliance. b. Importance of a High Compliance Rating: Builds trust among stakeholders & Reduces audit risks and legal scrutiny. c. Role of Kuber Consultancy Services: Ensuring timely and accurate filings to maintain high ratings & Regular follow-ups and updates to keep your compliance on track. d. Long-Term Benefits: Discuss how high compliance ratings can lead to better vendor relations and access to government schemes. |

Recent Blogs on Updates

Check below the recent updates:

No posts found!

Recent Videos on Updates

Check below the recent updates:

What can I find on Kuber Consultancy Services?

Kuber Consultancy Services offers comprehensive information coverage with regular updates, detailed analysis, and valuable content to keep you informed.

How often is the content updated?

We regularly update our information content to ensure you have access to the latest and most accurate information available in the industry.

Why choose Kuber Consultancy Services for information?

Kuber Consultancy Services is committed to providing reliable, well-researched information content from experienced contributors and trusted sources.

Good and timely GST return filing service. The team handled the GST Quick File process professionally and clarified all our queries properly.

Overall satisfied with the support and smooth experience

Good and timely GST filing service. The team handled the GST Quick File plan professionally and ensured everything was submitted without delay. They responded to our queries clearly and provided proper support.

Overall satisfied with the service.

Very reliable and prompt GST filing service. The GST Quick File plan was handled smoothly and completed on time. Clear communication and good support throughout the process.

Happy with the service and would recommend Kuber Consultancy Services to others.

Good experience with Kuber’s GSTCare (GST Quick File) service. The return filing was done on time and the team handled everything professionally. They clarified my doubts clearly and guided me properly.

Overall satisfied with the service and support.

Romba years-aa Kuber Consultancy Services use pannitu irukken. GST work smooth-aa, time-ku complete aagudhu. Trusted service

Romba years-aa Kuber Consultancy Services-oda work pannitu irukken. GST returns time-ku nadakkudhu, follow-ups clear-aa irukkum. Namakku unnecessary tension illa.

WhatsApp-la short status updates add panna innum convenient-aa irukkum. Overall-aa, trusted long-term service

GST filing nu sonnale headache, but Kuber Consultancy Services nala easy-aa mudinjiduchu. Ivanga side-la proper follow-up irundhuchu, documents clear-aa solli guide pannanga, so confusion illa. Work time-ku complete pannitanga.

One small suggestion-na, regular-aa WhatsApp updates or short reminders vandha super-aa irukkum. Ippo kooda service nalla irukku, adhu add aana innum comfortable feel varum.

Overall-aa paatha, safe hands-la irundha madhiri feel. Definitely recommend

Kuber Consultancy Services oda GST filing service romba convenient-aa irundhuchu. End-to-end process properly handle pannanga and reminders time-ku vandhuchu, so returns miss aagura chance illa. Queries-ku patient-aa explain pannanga, adhu romba helpful-aa irundhuchu.

Small improvement-na, client-ku simple dashboard or status tracker irundha filings status one glance-la paakara madhiri innum easy-aa irukkum. Ippo kooda process clear-aa irukku, but idhu add aana experience next level pogum.

Overall, trustworthy & smooth service. Definitely recommend pannalaam

Kuber Consultancy Services oda GST return filing service romba smooth-aa irundhuchu. Process clear-aa explain pannanga, time-ku filings complete pannanga and overall stress-free experience. Support team friendly-aa irundhanga and doubts ellam easy-aa clarify pannanga.

One small suggestion-na, email communication kooda SMS or WhatsApp updates-um vandha innum convenient-aa irukkum. Adhu vandha experience innum better aagum.

Overall, professional & reliable service. Business owners-ku definitely recommend 👍

Monthly GST returns were handled accurately and on time with clear communication. The team ensured compliance without any last-minute follow-ups from our side. Very professional and dependable service for ongoing GST requirements.

Thank you for your valuable feedback 😊

We’re glad Kuber’s GSTCare helped simplify your GST compliance. Timely filings and hassle-free support are what we strive for, and your appreciation means a lot to us 👍