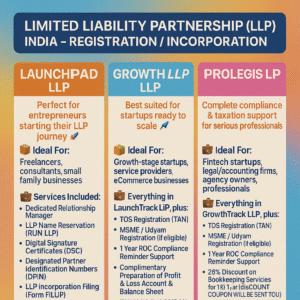

Description

Start, Register & Launch Your Business in India with Expert Legal Support

In India, forming a Private Limited Company (Pvt Ltd) or Public Limited Company (PLC) is one of the most trusted, scalable, and legally compliant ways of running a business. At Kuber Consultancy Services, we simplify the entire company incorporation process by offering an end-to-end, technology-driven platform for startups, entrepreneurs, SMEs, and growing businesses.

Whether you want to register a Private Limited Company for a startup, or launch a Public Limited Company for large-scale fundraising, our experts help you navigate every legal, compliance, and documentation requirement as per the Companies Act, 2013 and the guidelines of the Ministry of Corporate Affairs (MCA).

Our company registration service is designed to offer:

Fast processing

100% online documentation

Transparent pricing

Zero hidden charges

Dedicated CA, CS & legal team

Year-round compliance support

Kuber Consultancy Services ensures your business is legally ready from Day 1 with a strong foundation, accurate documentation, and complete regulatory compliance.

How Kuber Consultancy Services Simplifies Company Registration?Kuber Consultancy Services transforms the traditionally complex and paperwork-heavy company registration process in India into a smooth, fast, and fully guided experience. With a technology-driven approach and expert CA/CS-led support, we ensure entrepreneurs can incorporate their business without confusion, delays, or legal risk. Here’s how we simplify the entire journey from planning to registration and post-incorporation compliance. |

Characteristic Features of a Company

A Public or Private Limited Company in India has the following features:

a) Separate Legal Entity

The company exists independently from its owners. It can own assets, enter into contracts, sue and be sued.

b) Limited Liability Protection

Shareholders are liable only to the extent of their share capital—not personal assets.

c) Perpetual Succession

The company continues even if directors or shareholders change, retire, or pass away.

d) Transferability of Shares

Pvt Ltd: share transfer is restricted but possible.

Public Ltd: shares are freely transferable.

e) Mandatory Compliance Structure

Companies must file annual returns, maintain statutory registers, and conduct board meetings.

f) Professional Management

Management is carried out by directors, ensuring structured decision-making.

g) Capacity to Raise Funds

Companies can raise investment through:

Equity

Preference shares

Debentures

Venture capital

Angel investment

IPO (for Public Limited Companies)

h) Name Protection

Once registered, the name becomes legally protected nationwide.

i) Tax Benefits

Eligible companies can claim Startup India benefits, deductions, depreciation, and more.

Eligibility – Who Can Start a Company? (Minimum Requirements)

✔ Private Limited Company Requirements:

Minimum 2 Shareholders (up to 200)

Minimum 2 Directors

At least 1 Director must be an Indian resident

No minimum paid-up capital (₹1 is enough)

Registered office address in India

DIN & DSC for all directors

✔ Public Limited Company Requirements:

Minimum 7 Shareholders

Minimum 3 Directors

At least 1 Director must be an Indian resident

No minimum capital requirement

Registered office address in India

Foreign Nationals & NRIs

They can also register a company in India (with one resident director).

Benefits / Advantages / Pros

⭐ Strong Legal Identity

Build credibility with customers, suppliers, banks, and investors.

⭐ Limited Liability for Shareholders

Personal assets remain protected.

⭐ Easy Fundraising & Investment Opportunities

Ideal for startups seeking equity capital or VC funding.

⭐ Better Governance and Transparency

Corporate governance builds trust and long-term stability.

⭐ Perpetual Existence

Business continuity is unaffected by change in ownership or management.

⭐ Brand Reputation & Market Visibility

A Pvt Ltd or Public Ltd tag improves brand trust.

⭐ Easy Transfer of Ownership

Shares can be transferred without disrupting operations.

⭐ Suitable for Large and Growing Businesses

Scalable structure with multiple shareholders and directors.

⭐ Tax Advantages

Companies enjoy multiple tax benefits under the Income Tax Act.

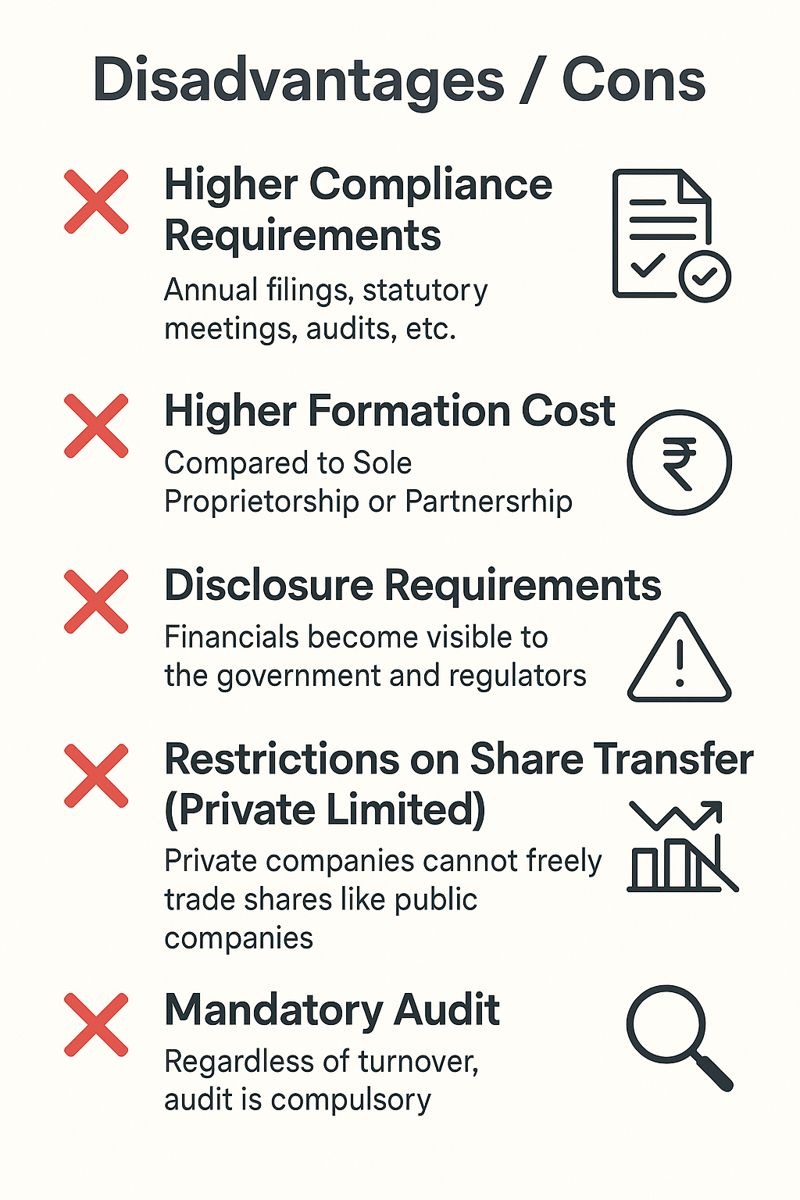

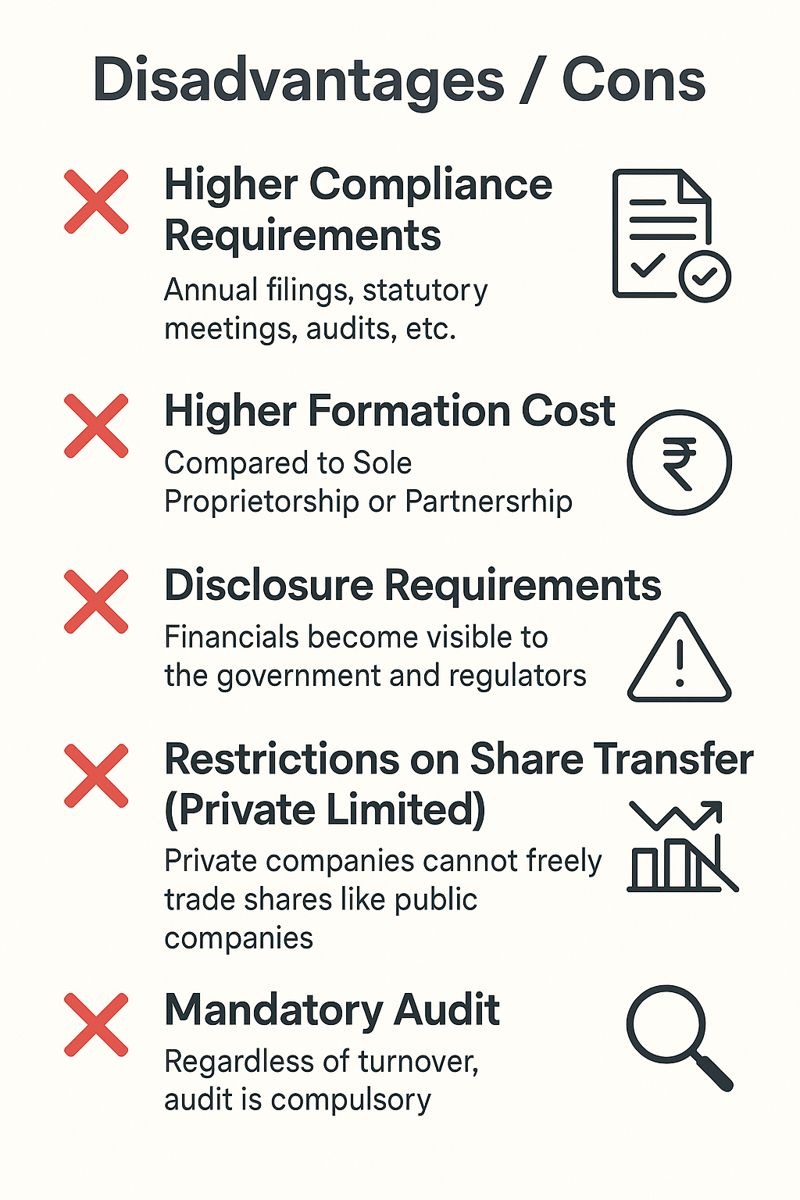

Disadvantages / Cons

❌ Higher Compliance Requirements

Annual filings, statutory meetings, audits, etc.

❌ Higher Formation Cost

Compared to Sole Proprietorship or Partnership.

❌ Disclosure Requirements

Financials become visible to the government and regulators.

❌ Restrictions on Share Transfer (Private Limited)

Private companies cannot freely trade shares like public companies.

❌ Mandatory Audit

Regardless of turnover, audit is compulsory.

Step-by-Step Process by Kuber Consultancy Services

Kuber Consultancy offers a smooth, fully managed incorporation process:

Step 1: Free Consultation & Business Structure Planning

We help you choose between Pvt Ltd / Public Ltd based on your goals.

Step 2: Name Reservation (RUN / SPICe+)

We file your company name with MCA for approval.

Step 3: Digital Signature Certificate (DSC) Preparation

DSCs for all proposed directors are prepared and verified.

Step 4: Director Identification Number (DIN) Application

DIN is generated for all directors through SPICe+.

Step 5: Drafting of MOA & AOA

We prepare the Memorandum of Association & Articles of Association tailored to your business.

Step 6: Filing SPICe+ Forms (INC-32, AGILE-PRO, INC-9, etc.)

We submit all incorporation forms including:

PAN

TAN

GST Registration (optional)

EPFO / ESIC registration

Bank account application

Professional tax (where applicable)

Step 7: MCA Verification

Government authorities check your application.

Step 8: Certificate of Incorporation (COI)

Once approved, you receive:

COI

Company PAN

TAN

Approved MOA & AOA

Step 9: Post-Incorporation Compliance Support

We assist with:

Bank account opening

First auditor appointment

First board meeting

Issue of share certificates

Statutory register preparation

Sole Proprietorship vs Company

| Feature | Sole Proprietorship | Company (Private/Public Limited) |

|---|---|---|

| Legal Status | A Sole Proprietorship has no separate legal identity from its owner. The business and the proprietor are legally the same entity, meaning all assets, liabilities, and legal responsibilities directly belong to the owner. This limits the business’s credibility with banks, investors, and government authorities as it operates informally without corporate recognition. | A Company is a separate legal entity registered under the Companies Act, 2013. It has its own identity, distinct from shareholders and directors. It can own property, enter contracts, borrow funds, sue and be sued in its own name, giving it higher credibility and stronger legal standing. |

| Liability | The proprietor has unlimited personal liability, meaning personal assets like house, car, and savings can be used to settle business debts or legal disputes. This exposes the individual to significant financial risks. | Shareholders enjoy limited liability, restricting their financial exposure only to the amount invested in shares. Personal assets remain safe even if the company faces financial losses or lawsuits, making it a much safer structure. |

| Compliance Requirements | Compliance is minimal. No mandatory MCA filings, board meetings, or statutory audits. Only basic tax filings are required, making proprietorship simple and inexpensive to run but less credible. | Companies must follow structured compliances such as annual returns, board meetings, audits, and statutory registers. Though compliance is higher, it ensures transparency and improves investor and banking confidence. |

| Funding & Investment | Funding options are limited because investors, banks, and VCs do not prefer informal structures. The business can rely mostly on personal funds or small loans. | Companies can raise funds through equity, private placement, venture capital, angel investment, debt instruments, or even public issue (for Public Limited Companies). This makes the company structure ideal for scalable and growth-oriented businesses. |

| Continuity | The business ends if the proprietor dies, retires, or becomes incapable of operating, leading to uncertainty in long-term continuity. | Companies enjoy perpetual succession, meaning changes in shareholders or directors do not affect the company’s existence. This stability ensures longevity and reliability. |

Partnership Firm vs Company

| Feature | Partnership Firm | Company (Private/Public Limited) |

|---|---|---|

| Legal Identity | A Partnership Firm does not have a strong separate legal identity from its partners. Even when registered, partners remain closely tied to the firm's obligations, and the firm may dissolve easily depending on the partnership agreement. | A Company is fully recognized as an independent legal entity. It exists regardless of member changes and continues to operate even if shareholders or directors leave, providing long-term stability. |

| Liability | Partners have unlimited, joint, and several liability, meaning each partner is personally responsible for the firm's debts and legal actions. Personal assets are always at risk. | Shareholders have limited liability, protecting them from personal exposure beyond their share capital. This drastically lowers risk and enhances financial safety. |

| Compliance | Partnership Firms have minimal compliance needs and are not required to file annual reports with MCA. Although easy to manage, they lack the structure and transparency required for large-scale business operations. | Companies must follow higher compliance standards such as annual returns, audits, board meetings, and statutory records. These improve governance, accountability, and investor confidence. |

| Funding Ability | Partnerships cannot issue shares and have limited potential to attract investors. Banks and VCs generally avoid funding due to lack of formal structure and unlimited liability. | Companies can raise funds through private equity, venture capital, angel investors, debentures, and even public issues. This makes them ideal for startups and high-growth ventures. |

| Ownership Transfer | Changing partners requires revising or dissolving the partnership deed, which can disrupt business operations. | Share transfers enable smooth ownership changes without affecting operations, making companies more flexible and scalable. |

LLP vs Company

| Feature | LLP (Limited Liability Partnership) | Company (Private/Public Limited) |

|---|---|---|

| Legal Structure | An LLP is a hybrid model with limited liability and partnership-style management. It operates with flexibility and fewer legal formalities while being a separate legal entity. | A Company is a more structured corporate entity governed by the Companies Act, 2013, with strict regulatory oversight and formal governance, offering higher credibility. |

| Liability Protection | Partners enjoy limited liability but remain responsible for wrongful acts committed by themselves. The level of protection, though strong, is not as robust as a company's corporate veil. | Shareholders have strong limited liability protection, and directors are responsible only for actions they commit. The corporate veil provides significant legal protection. |

| Compliance Requirements | LLPs have simplified compliance, and audits are mandatory only above certain turnover thresholds. This reduces operational costs but provides less oversight. | Companies must undergo mandatory audits and multiple annual filings regardless of turnover, offering greater transparency and investor trust. |

| Fundraising Options | LLPs cannot issue shares and therefore have limited investor appeal. Fundraising is mostly restricted to partner contributions or loans. | Companies can issue equity shares, ESOPs, preference shares, debentures, private placements, and can even raise capital publicly. This makes them the most investor-friendly structure. |

| Management Structure | LLPs are managed by designated partners, keeping ownership and management closely connected. This may limit scalability for larger operations. | Companies maintain a distinction between ownership (shareholders) and management (directors), enabling professional governance and smoother expansion. |

Public Limited Company vs Private Limited Company

| Feature | Private Limited Company | Public Limited Company |

|---|---|---|

| Membership & Ownership | A Private Limited Company is closely held with a maximum of 200 members, ensuring controlled decision-making and privacy. Suitable for family businesses, SMEs, and startups. | A Public Limited Company has no upper limit on shareholders and allows public participation. This structure supports large-scale expansion and broad ownership. |

| Share Transferability | Shares cannot be freely transferred and usually require approval from existing members, ensuring stability and control. | Shares are freely transferable and can be listed on stock exchanges, providing liquidity and attracting public investors. |

| Fundraising Capability | Private Limited Companies raise funds privately through venture capital, angel investors, private equity, ESOPs, and loans. They cannot issue shares to the public. | Public Limited Companies can raise funds from the general public through IPOs, public offerings, and rights issues, giving them the highest fundraising potential. |

| Compliance Requirements | These companies follow moderate compliance with less public disclosure, balancing structure with flexibility for small and medium businesses. | Public Limited Companies face extensive compliance requirements, SEBI oversight, public disclosures, audits, and strict governance norms to protect public shareholders. |

| Purpose & Suitability | Ideal for startups, SMEs, professionals, and family-run businesses wanting limited liability with controlled ownership. | Best suited for large enterprises aiming for public investment, market reputation, and large-scale operations. |

What can I find on Kuber Consultancy Services?

Kuber Consultancy Services offers comprehensive information coverage with regular updates, detailed analysis, and valuable content to keep you informed.

How often is the content updated?

We regularly update our information content to ensure you have access to the latest and most accurate information available in the industry.

Why choose Kuber Consultancy Services for information?

Kuber Consultancy Services is committed to providing reliable, well-researched information content from experienced contributors and trusted sources.

Reviews

There are no reviews yet