Finance Bill 2025: A Comprehensive Guide to India's Latest Economic Roadmap

Table of Contents

- Introduction

- Key Highlights

- Revised Income Tax Slabs & Regime

- The New Income-Tax Bill, 2025

- Digital Access for Tax Authorities

- Sectoral Reforms & Incentives

- Impact on Startups & MSMEs

- Boost to Consumption & Middle Class

- Macroeconomic Implications

- Criticism & Concerns

- Conclusion

- References

Introduction

- Introduction

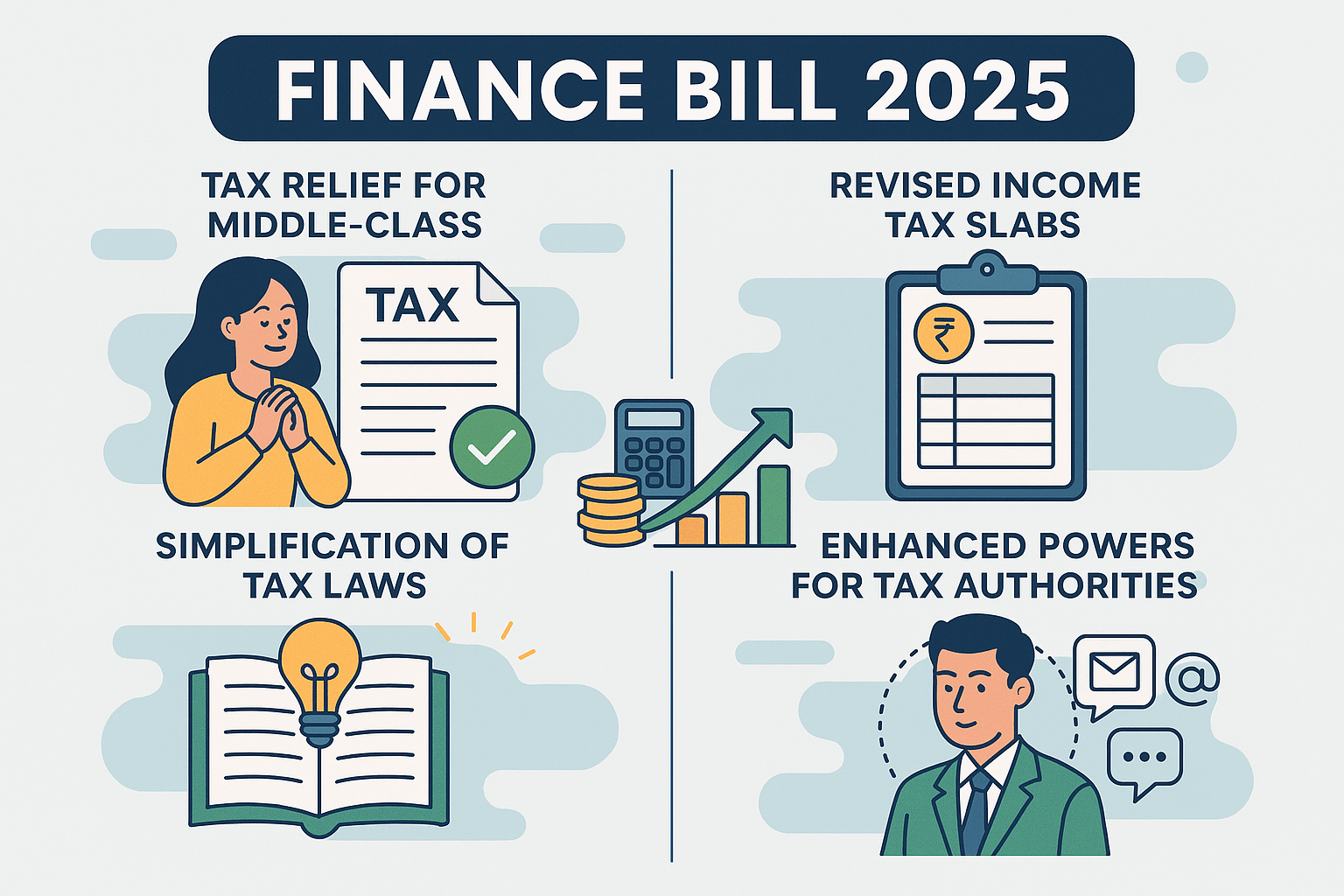

The Finance Bill, 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, lays the foundation for India’s journey towards becoming a developed nation by 2047. With a focus on digitization, tax simplification, inclusive growth, and modernizing legal frameworks, the Bill introduces transformative reforms intended to support a resilient and inclusive economy.

Key objectives include:

- Modernization of tax laws

- Promotion of ease of doing business

- Encouragement of digital compliance

- Support to critical sectors like agriculture, MSMEs, and green energy

This budget arrives at a critical juncture, responding to both global economic challenges and domestic aspirations.

- Key Highlights

Some of the most prominent announcements in the Finance Bill 2025 include:

- Income Tax Relief: A rebate under the new regime has been introduced, with no tax payable on income up to Rs. 12.75 lakh.

- Standard Deduction Hike: Raised from Rs. 50,000 to Rs. 75,000 for salaried and pensioned individuals.

- Income-Tax Bill 2025: A new code replacing the Income-Tax Act, 1961.

- Digital Powers to Tax Authorities: Proposal allowing access to electronic devices and social accounts under certain guidelines.

- Gig Workers Recognition: Provision for issuance of unique ID cards for welfare benefits.

- Boost for Priority Sectors: Credit and subsidies for agriculture, defense manufacturing, and renewable energy.

These highlights reflect the government’s intent to balance growth, simplification, and oversight.

- Revised Income Tax Slabs & Regime

The new tax regime becomes the default framework. The slabs have been rationalized to improve progressivity and reduce the burden on middle-class taxpayers.

New Tax Slabs (FY 2025-26)

Income Range (Rs.) | Tax Rate |

0 – 4,00,000 | Nil |

4,00,001 – 8,00,000 | 5% |

8,00,001 – 12,00,000 | 10% |

12,00,001 – 16,00,000 | 15% |

16,00,001 – 20,00,000 | 20% |

20,00,001 – 24,00,000 | 25% |

24,00,001 and above | 30% |

The aim is to make taxation simpler and reduce compliance costs while increasing transparency.

- The New Income-Tax Bill, 2025

Replacing the over 60-year-old Income-Tax Act, 1961, the new Income-Tax Bill 2025 is a comprehensive rewrite of India’s direct tax framework.

Notable Provisions:

- Simplified Legal Drafting: Easier to interpret and apply.

- Digital Integration: Designed for online filing, AI-assisted assessments, and e-verification.

- Focus on Equity: Addresses loopholes, introduces fair treatment across income groups.

- Reduction in Litigation: Predictable tax outcomes and structured dispute resolution mechanisms.

The new law is expected to modernize India’s tax ecosystem and boost investor confidence.

- Digital Access for Tax Authorities

A controversial but bold move, the Bill proposes allowing tax officers conditional access to a taxpayer’s:

- Digital devices such as laptops and mobile phones

- Cloud storage

- Social media and email accounts

Objective:

To curb large-scale evasion, undisclosed income, and fictitious transactions.

Safeguards:

- Prior approval from senior officials

- Restriction to ongoing investigations

- Accountability and audit trail requirements

However, this provision has sparked debate on privacy and surveillance

- Sectoral Reforms & Incentives

Agriculture:

- ₹5 lakh crore in subsidized loans

- Incentives for millet, oilseeds, cotton, and pulses

- Digitized land record verification for subsidy eligibility

Renewable Energy:

- Expansion of PLI scheme to solar, wind, and green hydrogen

- ₹30,000 crore allocation for infrastructure and R&D

Defense & Manufacturing:

- Increased capex for indigenous manufacturing

- Focus on strategic public-private partnerships

These reforms align with national priorities such as food security and energy independence.

- Impact on Startups & MSMEs

Startups and MSMEs receive a substantial boost:

- Tax holiday extension by 2 years for eligible startups

- Turnover threshold for presumptive taxation raised to Rs. 5 crore

- Simplified GST returns and refund timelines

- Access to low-cost credit via SIDBI and other channels

Additionally, a National Credit Guarantee Scheme for MSMEs has been revamped to improve disbursement.

- Boost to Consumption & Middle Class

The increase in standard deduction and rebate limit will directly raise disposable income.

Other Benefits:

- Reduction in TDS on freelance income to promote gig economy

- Removal of surcharge for specific slabs to improve net earnings

- Incentives for home buyers and first-time investors

These steps are designed to boost domestic consumption and stimulate demand in the economy.

- Macroeconomic Implications

- Estimated GDP Growth: 6.5% to 6.8% for FY 2025-26

- Fiscal Deficit Target: Reduced to 5.1% of GDP

- Tax Revenue Mobilization: Expected increase due to digital audits and better compliance

- Inflation: To be maintained within 4% to 5%

Overall, the bill is fiscally responsible while being pro-growth.

- Criticism & Concerns

Key Criticisms:

- Privacy Fears: Digital access clause perceived as invasive

- Healthcare Neglect: No major new allocation despite rising costs

- Urban Job Creation: Lack of targeted employment schemes

- Senior Citizens: Inadequate incentives or support in tax provisions

While the intent is bold, some feel execution mechanisms need stronger checks.

- Conclusion

The Finance Bill 2025 is a significant attempt to modernize India’s financial legislation. It strives to balance growth, tax simplification, and digital integration. With proper implementation, it can transform India’s compliance landscape and economic trajectory.

However, the government must ensure:

- Data privacy is respected

- Redressal mechanisms are functional

- Reforms are inclusive across sectors and classes

The coming months will determine how these proposals translate into reality.

What can I find on Kuber Consultancy Services?

Kuber Consultancy Services offers comprehensive information coverage with regular updates, detailed analysis, and valuable content to keep you informed.

How often is the content updated?

We regularly update our information content to ensure you have access to the latest and most accurate information available in the industry.

Why choose Kuber Consultancy Services for information?

Kuber Consultancy Services is committed to providing reliable, well-researched information content from experienced contributors and trusted sources.